Debt recycling is a financial strategy that has gained popularity in Australia in recent years. It offers individuals the opportunity to transform their financial landscape by leveraging their existing debt to build wealth and create a more secure financial future. Understanding the concept of debt recycling is essential for those looking to take control of their finances and maximize their wealth potential.

Understanding the Concept of Debt Recycling

The Basics of Debt Management Solutions Recommended by Financial Advisor Sydney

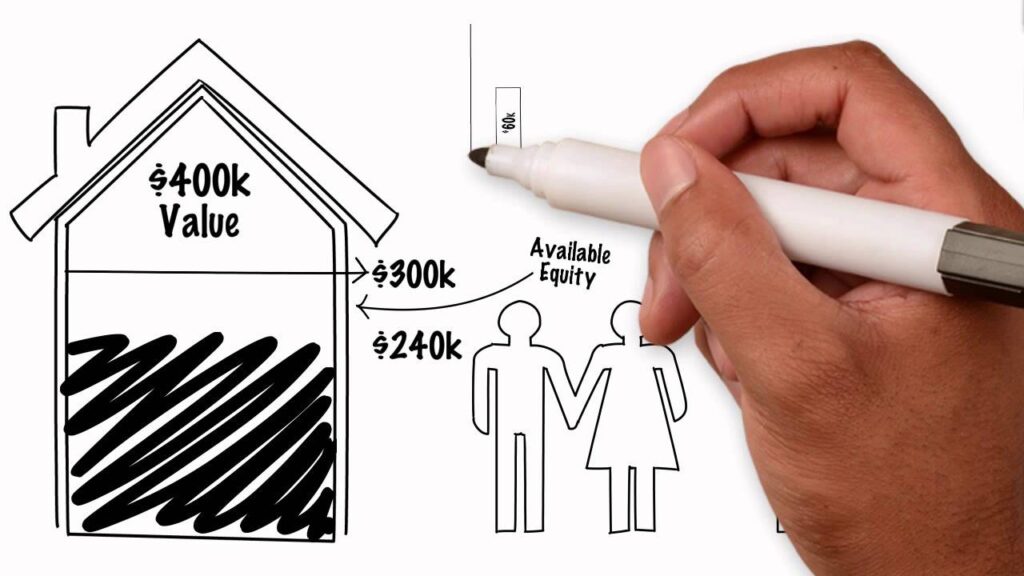

The debt management solutions recommended by financial advisor Sydney involves utilizing the equity in your property to finance investments while simultaneously paying off your non-deductible debt, such as your home mortgage or personal loans. By leveraging the equity in your property, you can redirect your non-deductible debt into a tax-deductible debt, such as an investment property loan or a margin loan.

Through debt recycling, you are effectively transforming your nondeductible debt into deductible debt, allowing you to potentially reduce your tax liability and accelerate your wealth creation over time. Click here to get more about what is debt recycling?

One key aspect to consider when engaging in debt recycling is the importance of conducting thorough research and seeking professional financial advice. Understanding the risks and benefits associated with leveraging your property’s equity is crucial in making informed decisions that align with your financial goals and risk tolerance.

The Role of Debt Recycling in Financial Management

Debt recycling plays a crucial role in effective financial management. By strategically managing your debt, you can harness the power of compounding growth and asset accumulation. Debt recycling allows you to utilize your property’s equity to build a diverse investment portfolio, potentially generating additional income streams and long-term wealth.

Moreover, debt recycling can serve as a strategic tool in optimizing your overall financial strategy. By reallocating your non-deductible debt into tax-deductible debt, you not only enhance your tax efficiency but also create opportunities for further investment diversification and risk management.

The Mechanics of Debt Recycling

How Debt Recycling Works

The mechanics of debt recycling involve a multi-step process that requires careful planning and execution. Firstly, you need to assess the equity in your property and determine the borrowing capacity available to you. This involves a thorough evaluation of your financial situation, including your income, assets, and existing debt.

Once you have identified your borrowing capacity, you can then apply for a loan to finance your investment activities. This loan will be secured against your property, allowing you to unlock the equity and redirect it into income-generating investments.

Expanding on the concept of unlocking equity, it is important to note that debt recycling can be a powerful wealth-building strategy. By leveraging the equity in your property, you have the potential to accelerate the growth of your investment portfolio and increase your overall net worth over time. This process requires discipline and a long-term perspective, as the benefits of debt recycling may not be immediately apparent but can yield significant results in the future.

Key Components of Debt Recycling

There are several key components of debt recycling that you need to consider. Firstly, you need to identify suitable investment opportunities that align with your financial goals and risk tolerance. This may include purchasing additional properties, investing in shares or managed funds, or establishing a self-managed superannuation fund (SMSF).

Moreover, diversification is a crucial aspect of successful debt recycling. By spreading your investments across different asset classes and sectors, you can reduce the overall risk in your portfolio and enhance its resilience to market fluctuations. This risk management strategy is essential for long-term financial sustainability and can help you navigate economic uncertainties with greater confidence.

Additionally, it is essential to carefully manage your cash flow to ensure you can comfortably service your investment loan. Regularly reviewing your portfolio’s performance and adjusting your investment strategy as needed is also crucial to maximize returns and mitigate risks.

Benefits of Debt Recycling

Financial Advantages of Debt Recycling

Debt recycling offers several financial advantages to individuals who implement this strategy effectively. Firstly, by redirecting your non-deductible debt into deductible debt, you may potentially reduce your taxable income, resulting in a lower tax liability.

Furthermore, through debt recycling, you can accelerate your wealth creation by leveraging your property’s equity to invest in income-generating assets. This has the potential to increase your overall wealth and create additional income streams, providing financial security and flexibility.

Another key benefit of debt recycling is the ability to diversify your investment portfolio. By strategically using the equity in your property to invest in different asset classes such as stocks, bonds, or mutual funds, you spread out your risk and potentially increase your investment returns over time.

Moreover, debt recycling can also serve as a valuable financial planning tool for retirement. By consistently managing and optimizing your debt structure, you can ensure a steady income stream during your retirement years, allowing you to maintain your desired lifestyle without financial stress.

Long-Term Impact of Debt Recycling on Wealth

The long-term impact of debt recycling on wealth involves the compounding growth and wealth accumulation potential it offers. By consistently redirecting non-deductible debt into deductible debt and reinvesting the income generated from your investments, you can achieve significant wealth accumulation over time.

Debt recycling enables you to harness the power of compounding returns and asset appreciation, positioning yourself for a prosperous financial future in the long run.

Furthermore, the wealth accumulated through debt recycling can also provide a solid financial foundation for future generations. By building a robust investment portfolio and managing your debt effectively, you can create a legacy of financial stability and security for your heirs, ensuring a lasting impact beyond your lifetime.

Risks and Challenges of Debt Recycling

Potential Risks Involved in Debt Recycling

While debt recycling offers significant benefits, it is crucial to be aware of the potential risks involved. One common risk is the fluctuations in the property and investment markets, which can impact the value of your assets and the income generated.

Additionally, taking on additional debt through debt recycling means an increase in your overall financial obligations. It is essential to carefully consider your repayment capacity and ensure you can comfortably manage your financial commitments, even during periods of economic uncertainty.

Moreover, another risk to consider is the possibility of interest rate hikes, which could lead to higher borrowing costs and put pressure on your cash flow. It’s important to have contingency plans in place to mitigate the impact of such scenarios and safeguard your financial stability.

Overcoming Challenges in Debt Recycling

To overcome the challenges associated with debt recycling, it is crucial to conduct thorough research and seek professional advice. Engaging the services of a qualified financial advisor or mortgage broker can provide valuable insights and guidance on structuring your debt recycling strategy effectively.

Furthermore, diversifying your investment portfolio can help spread risk and reduce the impact of market fluctuations on your overall wealth. By allocating your assets across different asset classes, such as stocks, bonds, and real estate, you can create a more resilient investment strategy that can withstand market volatility.

Debt Recycling Strategies

Effective Strategies for Successful Debt Recycling

Successful debt recycling requires careful planning and implementation of effective strategies. One key strategy is to regularly review and reassess your investment portfolio to ensure it remains aligned with your financial goals and risk tolerance.

By regularly reviewing your investment portfolio, you can identify any underperforming assets and make informed decisions on whether to reallocate your funds. This proactive approach allows you to capitalize on new investment opportunities that may arise, maximizing your potential returns.

Another effective strategy is to utilize your property’s equity to make additional loan repayments, accelerating the reduction of your non-deductible debt. By paying off your non-deductible debt faster, you can free up more equity for investment opportunities, further increasing your wealth potential.

Imagine the satisfaction of knowing that every extra dollar you put towards your non-deductible debt is not only reducing your financial burden but also opening doors to new possibilities. With each repayment, you are one step closer to achieving your financial goals and creating a secure future for yourself and your loved ones.

Tailoring Your Debt Recycling Approach

It is crucial to tailor your debt recycling approach to your unique financial circumstances and goals. Everyone’s situation is different, and what works for one individual may not work for another.

Consider consulting with a financial professional who can assess your specific needs and objectives and provide personalized recommendations. By tailoring your debt recycling approach, you can maximize the financial benefits and achieve long-term success.

Furthermore, a financial professional can help you navigate the ever-changing landscape of investment opportunities and market conditions. They can provide valuable insights and guidance, ensuring that your debt recycling strategy remains relevant and effective in the face of economic fluctuations.

Debt recycling has the potential to transform your financial landscape in Australia. By understanding the concept, mechanics, and strategies involved, you can harness its power to build wealth and secure your financial future. However, it is essential to approach debt recycling with careful consideration, seek professional advice, and regularly review your financial strategy to adapt to changing market conditions and personal circumstances.

Remember, your journey towards financial independence and long-term wealth creation is a marathon, not a sprint. With the right approach, debt recycling can be a transformative financial tool that propels you towards your goals, providing you with the peace of mind and financial security you deserve.